The Biosimilar Bottom Line: How Legacy PBMs Hide Millions

Written by

Alan Pannier

Dec 17, 2025

It’s a truth universally acknowledged that “brand-name” is synonymous with expensive: Americans expect it in their grocery aisles and at the pharmacy counter. This rings especially true when considering innovative, medically-transformative medications like biologics. Biologics are a medication class made or derived from living organisms, like bacteria, yeast, or animal cells. They are created via biological processes and contain complex molecules, such as proteins, antibodies, or DNA. Biologics can be used to treat autoimmune conditions, certain cancers, and other conditions. When they’re new to market, brand-name biologics are notoriously high-priced—and this pricing is justified by how resource intensive they are to bring to market.

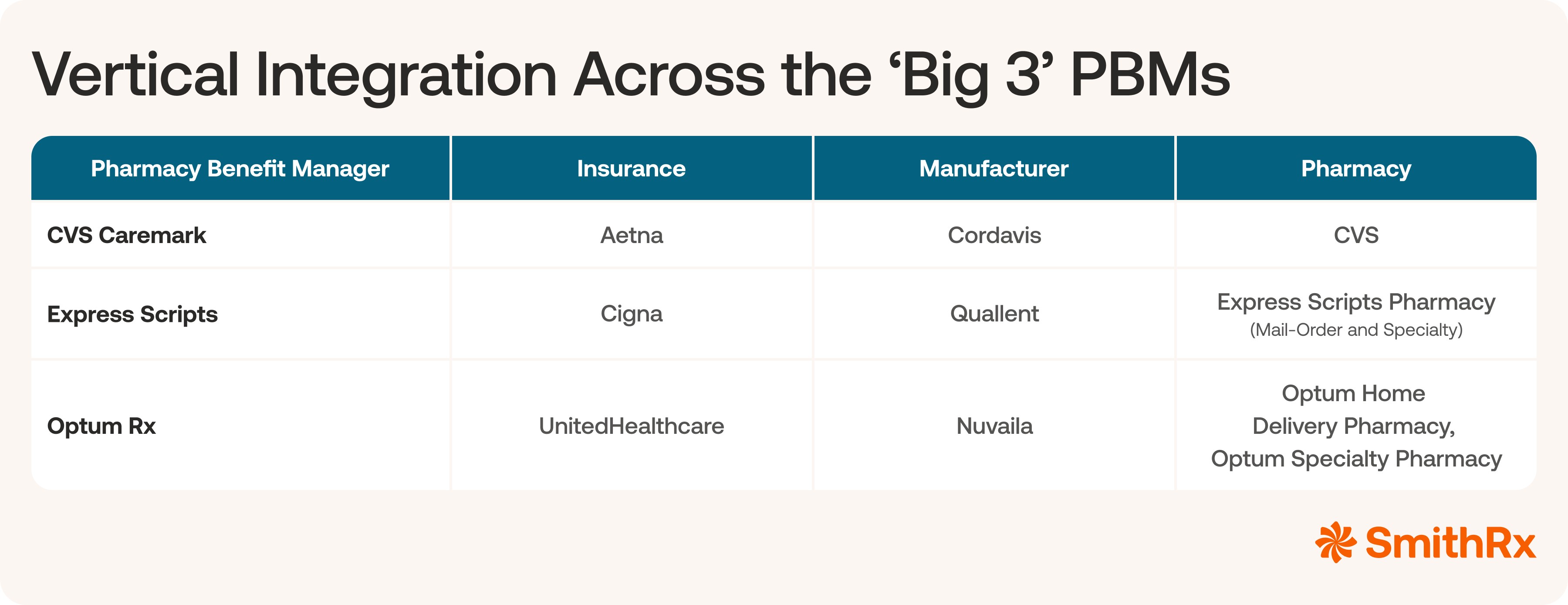

Similar to how generics are lower cost compared to the “brand-name”, biosimilars (highly similar versions of FDA-approved biologics) were supposed to follow a “patent cliff” and allow these impactful medications to be available at a much more affordable price. In reality, the largest legacy pharmacy benefit managers (PBMs) and their insurer, like CVS/CVS Caremark, Cigna/Express Scripts, and United Healthcare/OptumRx, have adopted an exploitive strategy: launching their own white-label or private-label biosimilars and jacking up prices.

The large legacy PBMs have marketed their private-label biosimilars as low-cost alternatives, but they’re really just a conflict of interest masquerading as competition. The truth is staggering. The massive margins legacy PBMs make on their white labels are hundreds of times greater than the profit made from transparent administrative fees offered by modern PBMs.

Ultimately, these inflated prices hurt businesses and members most—and most are totally unaware of just how bad of a deal they’re getting. Let’s explore the data behind biosimilar pricing for some of today’s most prescribed products and compare what kind of deal you get with legacy and modern PBMs.

Autoimmune Biosimilar Cost Breakdown: What Legacy PBMs Make from Margins

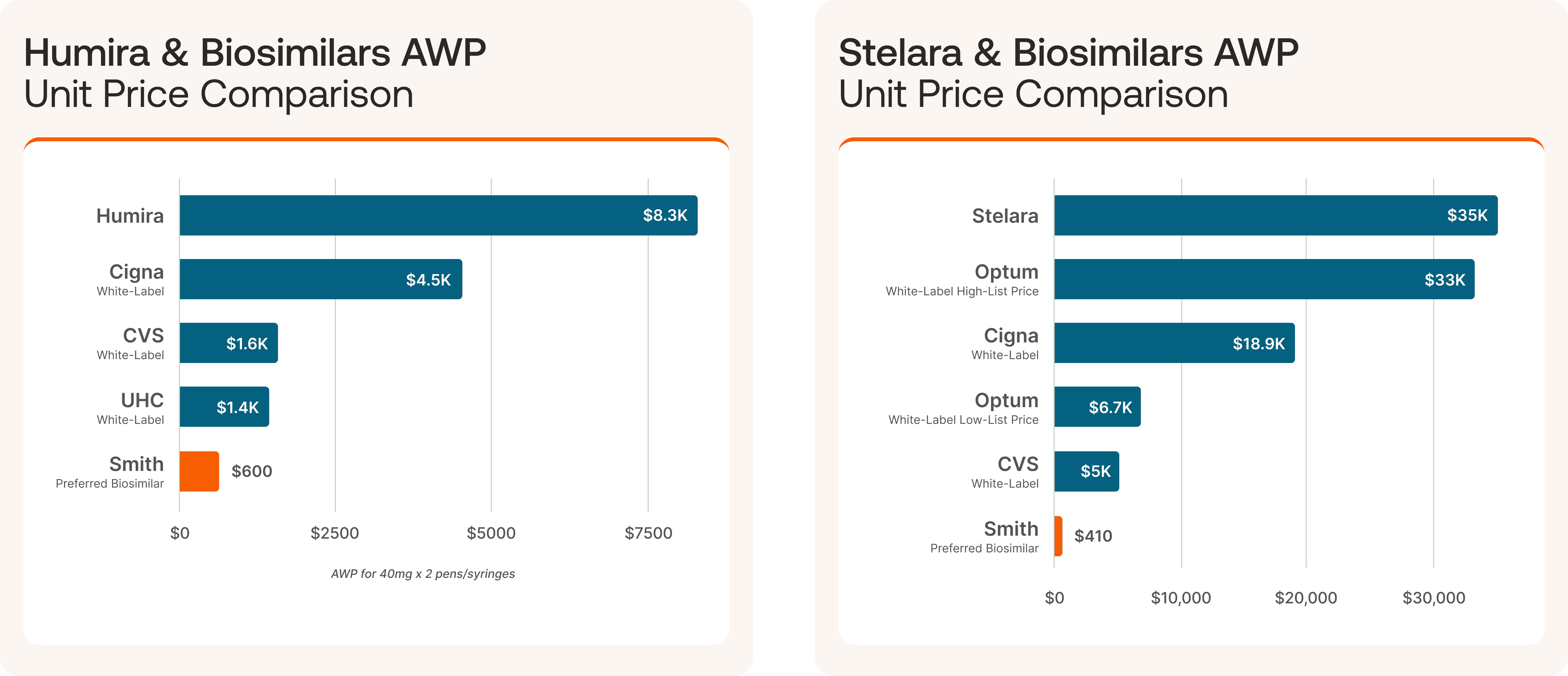

At SmithRx, we’re dedicated to getting our clients the lowest net cost for biosimilars. We’re experts at seeking out the lowest cost pathways for these medications—and we know it can be done. So, why do the Big Three PBMs continuously price their own biosimilars at rates of 14X, 38X, and 85X what modern PBMs do? The answer lies in the way they structure their business.

*Price discrepancies lead from margin and pricing games whereby even biosimilars are marked up to make rebate guarantees—and the end consumer pays the price.

The Big Three aren’t really just PBMs. When you dig, these are massive companies that own a slice of every part of the drug ecosystem: manufacturing, health insurance, benefits, and even dispensing. This phenomenon is known as vertical integration. Let’s meet the most egregious offenders of this practice:

To expose just how outrageous their pricing structures are, we first have to define the lowest competitive price. For two of the most well known biologics, Humira and Stelara, SmithRx delivers our preferred biosimilars for less than $600. No games, just optimizing for the lowest-cost product through the Drug Pathways Engine.

Humira: With our preferred biosimilar, we save clients 14X compared to brand-name and 4X from the average Big 3 biosimilar cost.

Stelara: We get biosimilars to clients for 85X less than the brand-name. Our preferred biosimilar is also still 38 times cheaper than the average white-label biosimilar from the Big 3.

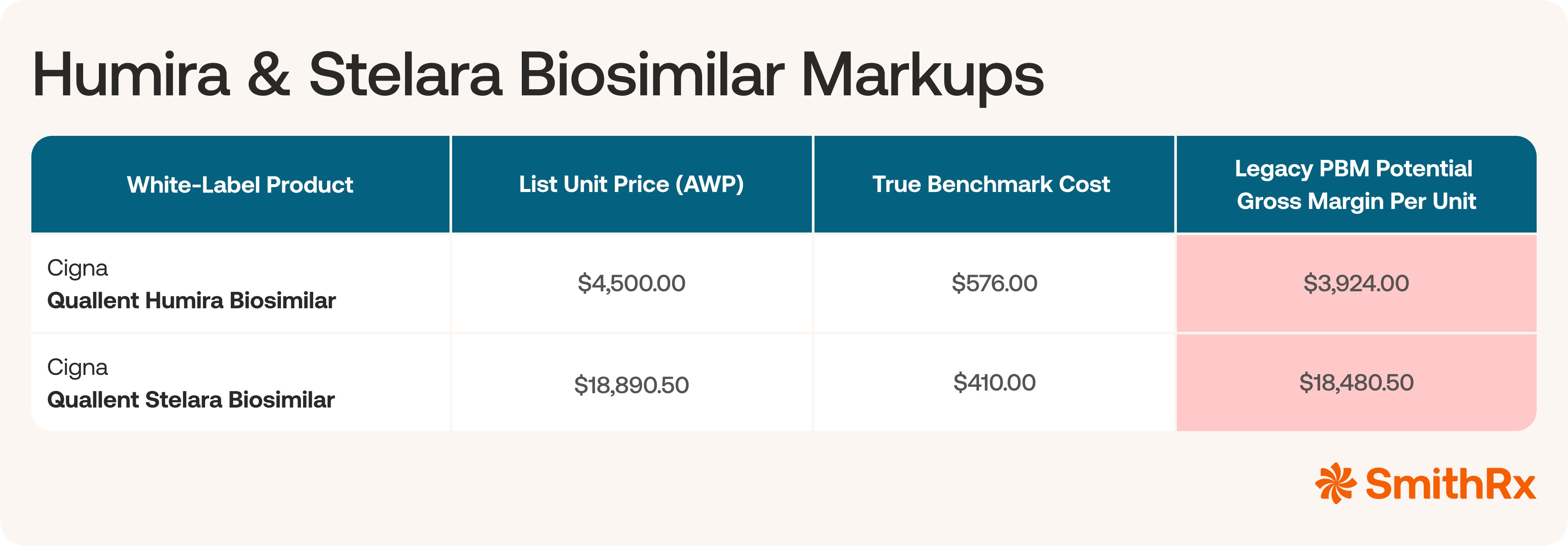

Let’s use Cigna as a case study for both biosimilars. Though their average wholesale price (AWP) comes out below the price for the brand-name medication, the pricing difference from a modern PBM like SmithRx is vastly different.

Why are these prices so high? Legacy PBMs will artificially inflate the list prices for their white-labeled biosimilars in order to meet discount guarantees they’re contractually obligated to deliver to clients, while still making sky-high profits off these drugs. So, while they may not be making nearly $20,000 from each fill, they are using these prices to meet those guarantees and retain or gain clients—and skimming off the top all in one.

The explanation for the large difference in cost is complicated: the legacy PBM owns the manufacturing (even though they don't actually manufacture the drug), it owns the PBM, and even the pharmacy it is dispensed at. This practice is called vertical integration—and it creates a conflict of interest that prevents a PBM from optimizing costs for plans. On top of that, legacy PBMs have spun a web of complicated pricing games and rebate structures whereby they’ll artificially inflate the prices of drugs in order to meet rebate or discount guarantees, but in the end plans still end up paying more.

By contrast, modern PBMs, like SmithRx, operate on a flat administrative fee, passing through the true, lowest net cost of the drug to the plan sponsor. This model incentivizes the PBM to find the lowest cost drug available. But when a PBM owns the drug label, its incentive flips: it's motivated to steer patients toward its own high-margin product, even if a lower cost, identical alternative exists. After all, if the PBM owns the manufacturing of the product they set the price. So if they were truly working in the best interest of their clients, then they would set the lowest possible price? They claim their size and scale provides competitive unit pricing but that isn't what we are seeing with biosimilars.

How These Prices Play Out at Scale

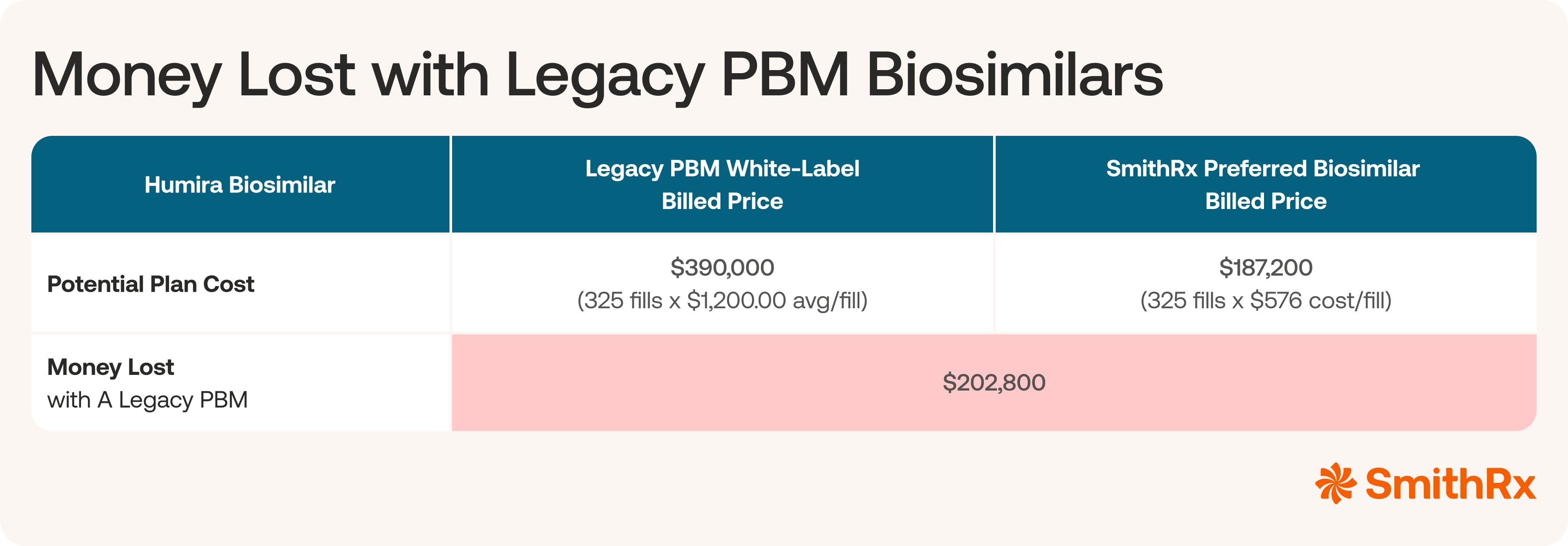

While the financials of individual biosimilar fills are already staggering, to truly understand the severity of these conflicts of interest, we need to examine the total annual costs for plans on the scale of thousands of employees.

Let’s apply these margins to a conservative, hypothetical 5,000-life health plan. We have a few assumptions for a plan of this size:

Utilization: We’ll estimate approximately 5 members per 1,000 utilize an adalimumab product (like Humira) annually. This is 25 members for a 5,000-life plan.

Annual Fills: Adalimumab typically requires about 13 maintenance fills per year (dosing every two weeks).

Total Annual Fills: 25 members x 13 fills/year ≈ 325 fills for the plan each year.

With legacy PBM’s “cost-effective” white-labeled biosimilars, you still stand to lose millions. The difference in what’s billed and paid for versus the true benchmark cost is truly staggering. Now that the corruption is clear—how can you ask the right questions of your PBM and spot a bad actor before you pay the price? Even in a scenario where a rebate is paid to lower the net cost it is still 100%+ higher than the lowest available product.

Is Your PBM Aligned on Biosimilars?

Looking at the data and the real numbers behind medication pricing, it’s easy to dismantle the facade of the legacy PBM model. Their incentive is not to secure the lowest possible cost for employers and members; their incentive is to look good on paper with the discounts they offer. They’re using the biosimilar market as a new, complex revenue center—and it is costing plan sponsors millions.

If you’re an employer or benefits consultant seeking true cost reduction, you must demand transparency and alignment from your PBM.

This requires that you completely change the way you think about your pharmacy benefits relationship. Don’t ask questions like, “What’s the discount you’re getting me off of AWP?” They’ve manipulated the market to be able to offer huge “discounts” that leave you paying more. The legacy PBM's own AWP for their white-label product is the inflated starting point for their profit engine. Simply put, their model is not aligned with your financial success.

Instead, dig deeper. If they can’t confirm the true, verifiable Acquisition Cost of their white-label biosimilar and how it compares to the lowest available net acquisition cost of an unbranded biosimilar option, like the ones we explored today, that’s a huge red flag.

The promise of biosimilars as a cost-containment strategy is real, but it can only be realized through a transparent, modern PBM partner whose revenue is derived solely from a fair, fixed administrative fee. When a PBM’s success is aligned with your savings, the true bottom line benefits everyone.

Written by

Alan Pannier

Chief Strategy Officer, SmithRx

Alan oversees the company's pharmacy initiatives, including manufacturer relations, network management, and clinical solutions. His background includes clinical leadership roles at Magellan Health and Veridicus Health, as well as hands-on experience as a practicing pharmacist. Alan's academic credentials include an MBA and PharmD from Idaho State University, a Bachelor's in Chemistry and Business from Westminster College, and specialized training in managed care pharmacy. His comprehensive understanding of the industry drives SmithRx's innovative approach to pharmacy benefits management.